36+ Irs Mileage Calculator

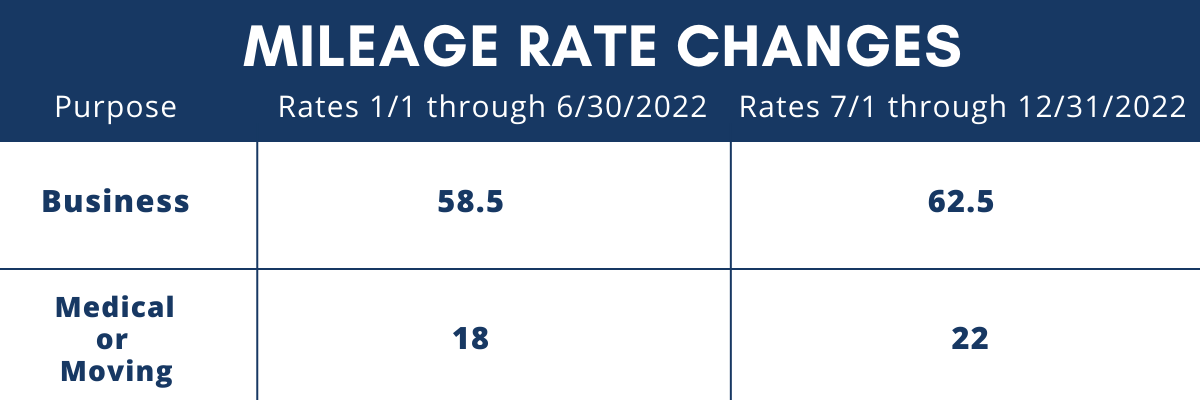

Web IRS issues standard mileage rates for 2022. 22 cents per mile for medical and moving purposes.

Mileage Reimbursement Calculator Mileage Calculator From Taxact

Web Multiply the total number of business miles by the IRS standard mileage rate to get the total deduction amount.

. The IRS has announced that the 2023 business standard mileage rate is increasing to 655 cents up 3 cents from the 2022 midyear adjustment of 625 cents. Web 17 rows Find optional standard mileage rates to calculate the deductible cost of. Web The change took effect Jan.

Every December the IRS announces the federal mileage rate for the following year. Web IRS issues standard mileage rates for 2021. For example if you drove 5000 business miles during the tax year and the standard mileage rate is 058 per mile your Deduction would be 2900 5000 miles x 058mile.

To find your reimbursement you multiply the number of miles by the rate. 14 cents per mile for charity purposes. Web There are 2 ways to calculate these expenses.

IRS Standard Mileage Calculator 1. Web IRS Standard Mileage Rates from Jan 1 2023. Web As of 2023 the mileage rate is now 655 cents per mile.

How It Works Use this tool to. Estimate your federal income tax withholding. Keep in mind that this mileage calculator only provides estimated mileage based on information you provide.

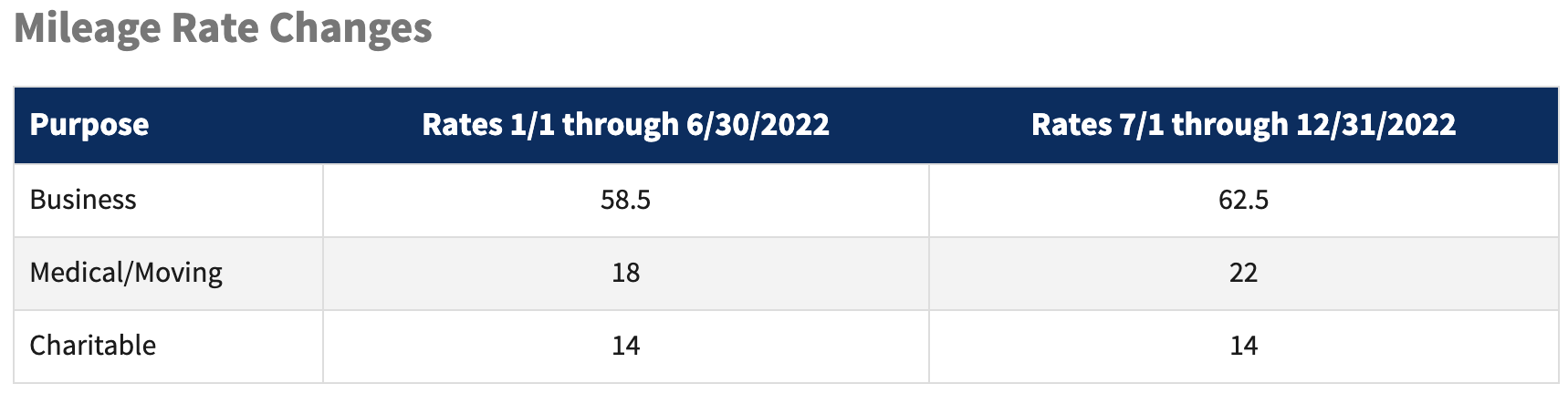

Individuals who are reporting this deduction will have to factor this change into their calculations come tax time. For the first half of 2022 the rate was 585 cents per mile and for the second half it was 625 cents per mile. Try out this calculator to automatically calculate your mileage.

WASHINGTON The Internal Revenue Service today issued the 2021 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business charitable medical or moving purposes. You can use our complimentary calculator below and if you need a mileage tracker app that ensures that your mileage logs are IRS-Proof look no further. It can also help you find out the cost of an upcoming road trip and understand the daily costs of driving your car.

See how your withholding affects your refund take-home pay or tax due. 655 cents per mile for business purposes. This is tax withholding.

Miles rate or 175 miles 0655 11463. When does the IRS mileage rate change. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

Web This calculator takes into consideration the current IRS mileage rate and delivers a quick clear output of what the mileage deduction figure is. IR-2021-251 December 17 2021. WASHINGTON The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business charitable medical or moving purposes.

Web Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Along with cars vans pickup trucks or panel trucks powered by gasoline and diesel the current IRS mileage rates also apply to hybrid and electric. Web Using a mileage calculator can help you figure out how much you should be reimbursed for work-related travel.

Web WASHINGTON The Internal Revenue Service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. IR-2020-279 December 22 2020. Web The 2023 standard mileage rate is 655 cents per mile.

This is an increase of three cents. Web IR-2022-234 December 29 2022 The Internal Revenue Service today issued the 2023 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business charitable medical or moving purposes. Web For 2023 the business standard mileage rate is 655 cents per mile a 3-cent increase from the 625-cent rate that applied during the second half of 2022see our Checkpoint article.

Either using the federal standard mileage rate set by the IRS every year or the actual expense method. The rate when an automobile is used to obtain medical carewhich may be deductible under Code 213 if it is primarily for and essential to the medical.

2023 Mileage Reimbursement Calculator Travelperk

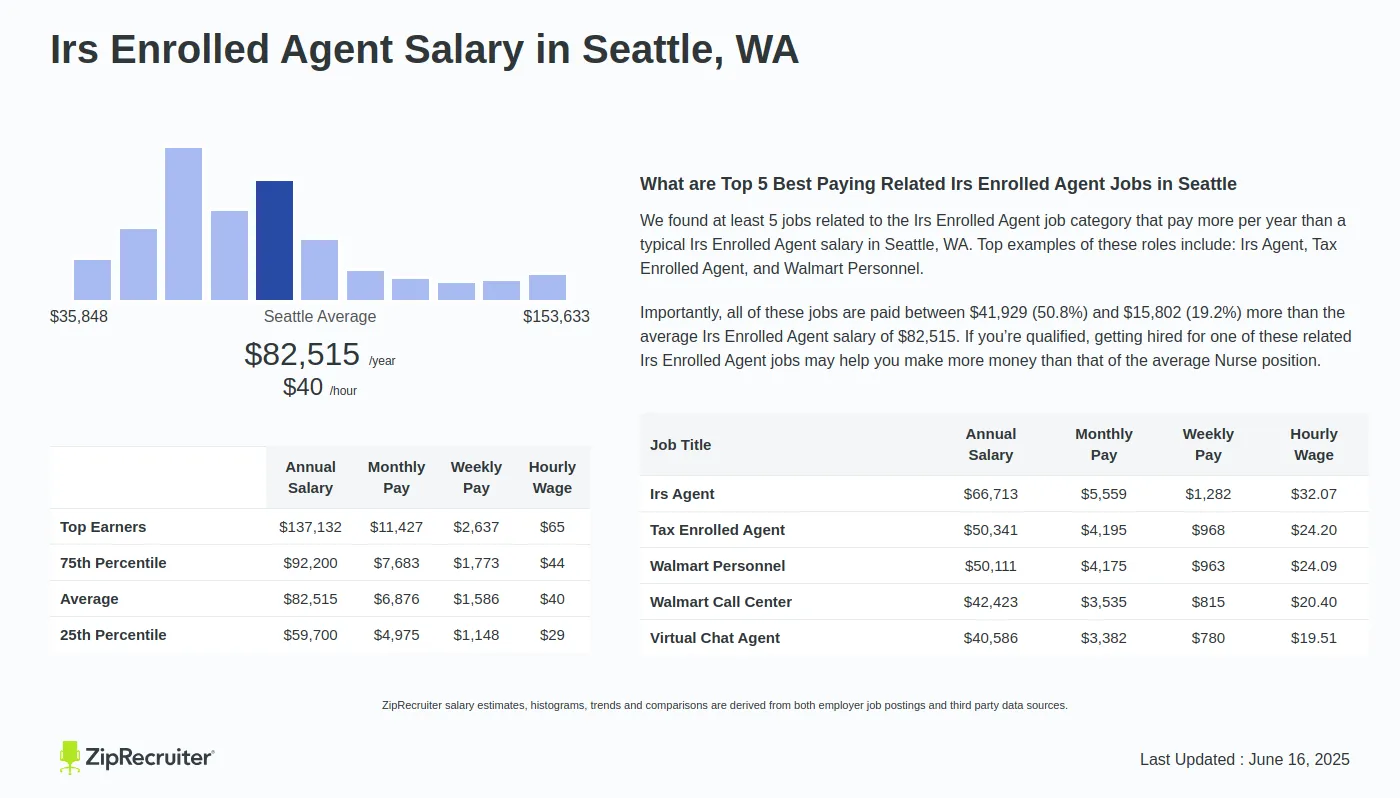

Salary Irs Enrolled Agent In Seattle Wa Oct 2023

Bart Wronski Technology Programming Art Machine Learning Image And Signal Processing

2021 Irs Business Mileage Rate Calculated Using Motus Data

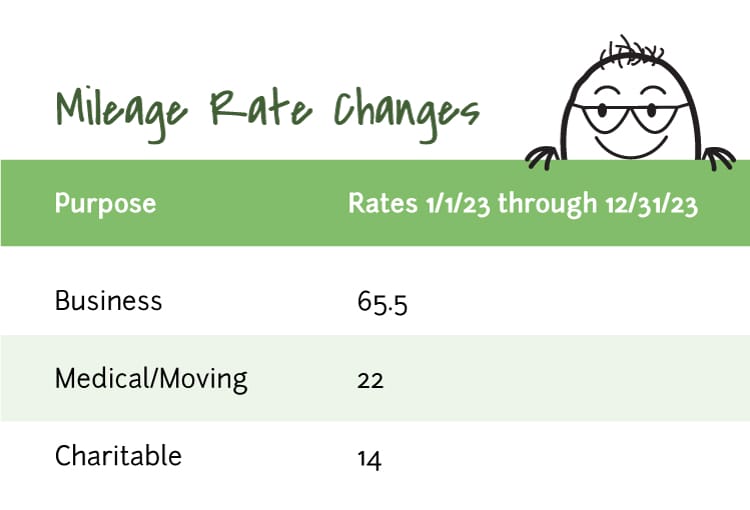

Mileage Rate Change For 2023 Cpa Nerds

2024 Nord Star 36 Finland Boats Com

How To Calculate Mileage Reimbursement Irs Rules Mileiq Mileiq

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

September 1 2021 Packet By Capitol Region Watershed District Issuu

2023 Mileage Reimbursement Calculator Travelperk

Bart Wronski Technology Programming Art Machine Learning Image And Signal Processing

Irs Increases Mileage Rate For Remainder Of 2022 Llme

Mileage Reimbursement Vs Car Rental Calculator Enterprise Rent A Car Enterprise Rent A Car

Pdf An In Service Analysis Of Maintenance And Repair Expenses For The Anti Lock Brake System And Underride Guard For Tractors And Trailers

Amazon Com Autel Maxiim Km100 Auto Key Fob Programming Car Key Programmer Tools Key Creation Immo Learning Chip Read Write Clone Includes 2pcs Programmable Ikey For 90 Cars Lite Of Im508s Im608 Pro Ii

Xxfzosecqlrwam

Irs Announces Midyear Increase To Mileage Reimbursement Rate Kruggel Lawton Cpas